With the Chinese search market demonstrating falls in ad revenues, are we going to see similar falls in online ad revenues for the likes of Google and Facebook’s ad revenues at least in the short term?

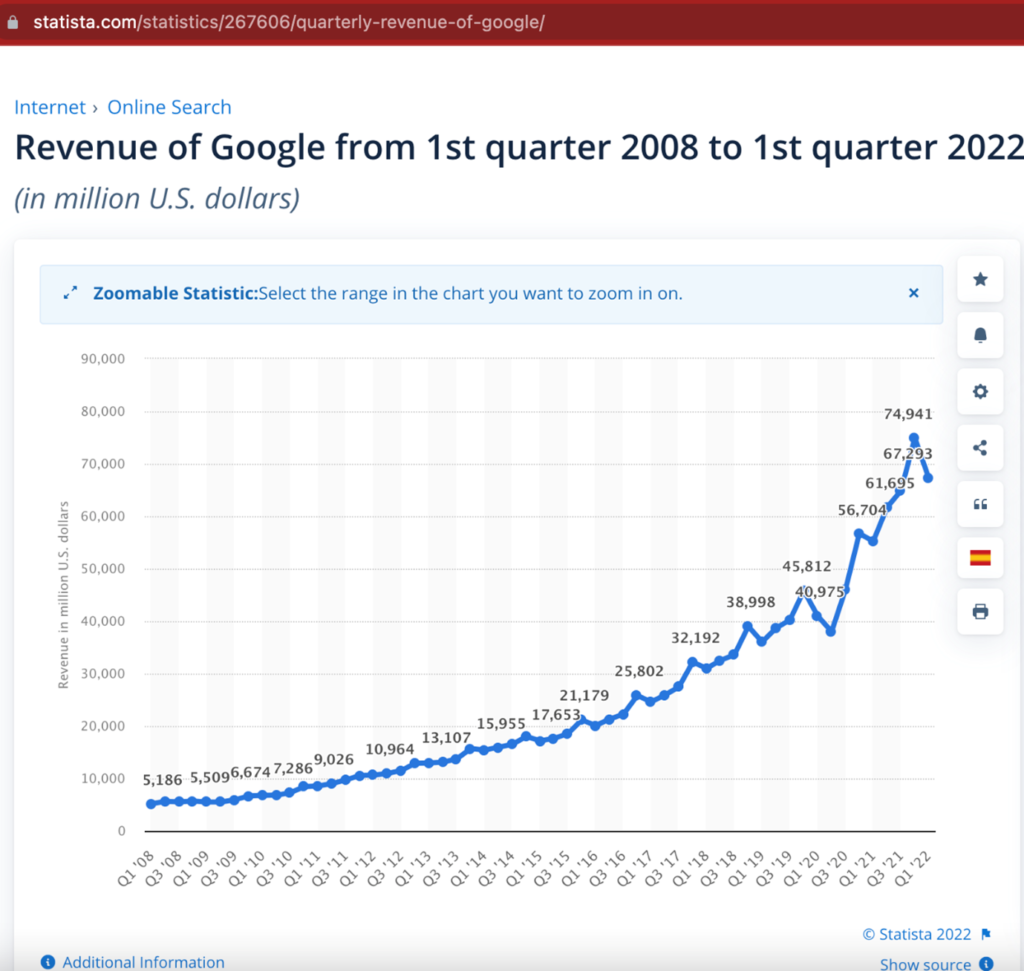

For many of us in the West working in the search and online advertising market, all we have largely known is an upward growth curve in the main industry players of Google and Facebook, exemplified by their revenues.

Yet as the Wall St Journal shows this isn’t the case in China right now. Search Ad revenues dominated by the Chinese of equivalent of Google, Baidu, are actually falling off.

https://www.macrotrends.net/stocks/charts/BIDU/baidu/revenue

Critics of this comparison will point out that Baidu’s revenues, whilst flowing upwards have been a little more volatile than the Western “Big Two”. The Chinese government has clamped down heavily on the tech industry for abuse of power. As a result, many tech sector workers in China are struggling to find jobs and taking lower paid non managerial jobs in order to find work. This seems almost unthinkable in the West. https://www.ft.com/content/cc3e25c3-a8a4-4b4c-9f0c-77cf0777fd4b

Furthermore, China has entered another period of lockdown, and it has been particularly Draconian by all accounts. Many consumers in China, now stuck at home, have switched away from cosmetics and clothing to more essential items in their shopping like higher quality foods and beverages. Travel is limited when a lockdown forbids you leaving your home rather than visiting a neighbour. Such shifts have reduced online advertising revenues.

However, it is pretty clear that Western governments are starting to catch up with their Chinese counterparts. The EU has led a war on Cookies which means online tracking, as we know it, will come to an end in 2023. Whether that will lead to a reduction in Google and Facebook revenues is another matter. Part of the growth of advertising in Google and Facebook was the ability to measure its effectiveness. And Google in particular is very effective at what Google used to describe as “the moment of truth”; where the consumer decides to buy a product or service and uses Google as the final checkpoint prior to purchasing. Many start up retailers would avoid the earlier clicks in the sales funnels and try to buy the long tail or product specific sku codes right at the end of the journey. As Google matured, buying YouTube and developing its content network of mostly 3rd party display websites, its language and emphasis sought to refocus advertisers on earlier parts of the consumer journey, mainly though ignoring offline advertising which made the same arguments about branding and earlier touch points in the journey. Despite few transactions appearing in most advertisers accounts as in anyway stemming from YouTube, Google has begun to reduce visibility of the clicks that cause transactions on advertiser’s websites. Google’s new Product Max for Google Shopping provides a lack of visibility similar to its predecessor Smart Shopping. Search terms that don’t convert are hidden from advertisers, as if the advertiser cannot be trusted to optimise their own data. Regardless of Google’s defence of such actions, its difficult to see how this won’t result in more revenues for them.

China may offer some interesting benchmarks as to where the western search and online advertising markets may be heading. However, the regulations being forced in the West may well benefit the major platforms rather than hinder and punish them.